One of the standout features of QuickBooks Simple Start is its ability to generate insightful reports. These reports provide a deeper dive into your business’s financial performance and health. From visualizing your revenue streams to assessing the impact of expenses, these reports offer invaluable data-driven insights that empower you to make strategic decisions. Upon logging into QuickBooks Simple Start, you’ll be greeted by the homepage, which serves as your starting point for accessing critical financial information. This page provides a snapshot of your business’s current financial status, showcasing key figures such as account balances, outstanding invoices, and expenses.

- As a Priority Circle member, you get access to a dedicated customer success manager who can assist you with any questions or issues you have with your software.

- The QuickBooks Online plan that’s best for you largely depends on the number of users who will be using the program, the size of your business and your particular needs.

- Whether you’re a small business owner, a freelancer, or just starting out on your entrepreneurial journey, managing your finances effectively is crucial.

We are committed to providing you with an unbiased, thorough, and comprehensive evaluation to help you find the right accounting software for your business. We meticulously and objectively assess each software based on a accounts receivable job description fixed set of criteria—including pricing, features, ease of use, and customer support—in our internal case study. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Don’t be intimidated by the size of the tutorial―take one lesson or tutorial at a time. There are 55 guides in our QuickBooks Online tutorial, spanning eight main modules. You should plan at least two hours to complete the first module, which includes 14 video tutorials. The true power of QuickBooks Simple Start lies in its reporting capabilities.

Shelley Elmblad is an expert in financial planning, personal finance software, and taxes, with experience researching and teaching savings strategies for over 20 years. By using QuickBooks Payroll, all your wages, salaries, and payroll taxes will be included automatically in your financial statements. After this lesson, you’ll be able to set up employees in QuickBooks, enter and run payroll, pay employees by direct deposit or check, and reconcile your payroll taxes.

Plans for every kind of business

QuickBooks Online is one of the preeminent cloud-based accounting software platforms on the market. With four plans available, there are several options from which to choose, depending on your needs. In this guide, we’ll break down QuickBooks Online pricing, including plans, key features, and alternative platform costs so you can decide which option is best for you. With Simple Start, you’ll find a good set of features in this online accounting software without being overwhelmed by unneeded modules.

Large businesses that need access for up to 25 users will probably want to go with QuickBooks Advanced. Although QuickBooks Online is a great cloud-based accounting platform, it isn’t the only one. Yes, QuickBooks Online offers a mobile app that allows you to access your account, track expenses, create and send invoices, and more, all from your smartphone or tablet. We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

Gaining Insights Through Reports

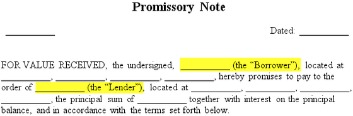

You just need to create a single invoice template and then apply it to all the customers who require the same invoice. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software. Our free QuickBooks tutorial series starts with setting up QuickBooks Online for your business. Invoicing is a critical aspect of maintaining cash flow and ensuring timely payments.

What are the Differences Between Warehouse 15 and Warehouse Manager in QuickBooks?

Or let a tax expert powered by TurboTax do your taxes for you, start to finish. QuickBooks Simple Start earns 4.5 stars, but it’s best for very small businesses. It is not objectivity principle adequate for businesses managing substantial inventory or that require a considerable amount of fiduciary oversight. Whether they work in-house or externally, accountants can use QuickBooks to automate and simplify tedious tasks and gain deep insights to drive growth for your business.

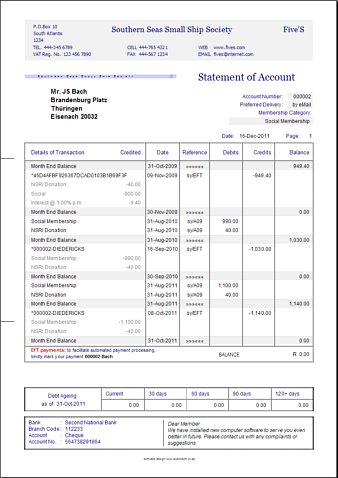

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units. The banking section of this case study focuses on debits and credits cheat sheet: an accounting guide for 2023 cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash. To delve deeper into our best small business accounting software, we tested and used each platform to evaluate how the features perform against our metrics.